DEFA14A: Additional definitive proxy soliciting materials and Rule 14(a)(12) material

Published on February 14, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

HPS Corporate Lending Fund

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

The following letter will be sent to shareholders of HPS Corporate Lending Fund (the Company), beginning on or about February 18, 2025, regarding the Special Meeting of Shareholders to take place on April 16, 2025 (the Special Meeting).

R Corporate Lending Fund We Need Your Vote Dear Shareholder, acquired On December by BlackRock, 3, 2024, HPS Inc. (BlackRock), Investment Partners subject LLC to customary (HPS) announced closing conditions that it had . We entered believe into our a partnership definitive agreement with BlackRock to be (HLEND) has the potential shareholders to enhance . In connection our ability to with continue the transaction, to deliver attractive we need your risk- adjusted approval returns of a new to investment HPS Corporate advisory Lending contract Fund between transaction HLEND (the New and HPS Investment Advisors, Advisory LLC (HLENDs Agreement existing Proposal) investment . adviser) which will take effect upon the closing of the Your vote is very important. All members of HLENDs vote Board of Trustees who considered the New Investment Advisory on Agr numerous eement Proposal reasons, unanimously including the recommend ones listed that below you (which FOR are described the New Investment in more detail Advisory on the Agreement next page): Proposal, based HPS intends to continue to manage HLEND full control on a consistent over HPS Advisors, basis post LLC -transaction; and its management of The HPS HPS Advisors, leadership LLC will team continue will retain toact as HLENDs investment adviser and the new investment advisory HLEND; agreement will not change the type or cost of services it provides to HLEND; HPS HPS believes believes the that BlackRock BlackRocks transaction scale also will offers increase other potential benefits origination for HLEND opportunities; shareholders and . We also need your approval to contingently delay the special potential meeting of shareholders to consider the New Investment requirements Advisory Agreement (the Adjournment Proposal (currently Proposal) scheduled . All members for April of HLENDs 16, 2025), Board as necessary, of Trustees to who ensure considered we meet the minimum Adjournment voting Thank Proposal you unanimously in advance for recommend your participation that you in vote this FOR important the Adjournment matter and for Proposal your continued . support of HLEND. If you have any questions, please contact your financial advisor or call our proxy solicitor, Broadridge, at 1-833-210-2111. Sincerely, Chairman Michael Patterson and Chief Executive Officer of HLEND ONLINE QR CODE WWW.PROXYVOTE.COM Vote WITH by A scanning SMARTPHONE the Quick Response Code or Please have your proxy card in hand when accessing the website. There are easy-to-follow directions to help you QR Code on the Proxy Card/VIF enclosed. complete the electronic voting instruction form. PHONE MAIL WITHOUT A PROXY CARD Call 1-833-210-2111 Monday to Friday, 9:00 a.m. to VOTE Mark, sign PROCESSING and date your ballot and return it in 10:00 p.m. ET to speak with a proxy specialist. the postage-paid envelope provided. WITH Call 1- 800 A PROXY -690-6903 CARD with a touch-tone phone to vote using an automated system.

R Corporate Lending Fund You Should Vote FOR Consistent strategy or operating Approach approach to HPSs post Management -transaction and . HLEND Support will continue of HLEND to. be There managed will be by no the changes HPS Direct to HLENDs Lending Investment investment team, accounting, led by operations, Michael Patterson, legal and using compliance the investment teams will process continue HPS to has support successfully HLENDs employed operations, for 17 and years no material . HPSs financing, changes HPS are expected Wealth Solutions to operational team. or control processes. Finally, shareholders and their advisors will continue to be covered by the Continuity senior leadership of HPS team Leadership is expected Team to remain and Ongoing in their Control current. positions The HPS GP/LP with oversight solutions of businesses HPS and BlackRocks post-transaction existing closing private . HPS credit, leadership CLO, will and have full control over all matters related to the combined business that we Please vote Specifically, believe are essential subject to to the preserving oversight the of HLENDs culture and Board performance of Trustees, of as HPS ap-. FOR plicable, and what HPS it invests leadership in, all personnel will retain decisions full control related over to how the HLEND HPS personnel invests today pensated), investing on and behalf relationship of or supporting management HLEND with (including HLENDs how shareholders they are com and- their advisors. No Advisors, Substantive LLC will Changes remain HLENDs to the Investment investment Advisory adviser under Agreement the proposed . HPS Your prompt participation continue new investment to be provided advisory by agreement the HPS and team investment . The scope advisory of the services services pro will- additional will reduce communication the need for vided The only and changes financial to terms the terms at which of the they new are investment provided advisory will be unchanged agreement. proposals with you regarding . Your vote the is are following the time the period closing over of the which transaction) the agreement and the will inclusion be in force of a provision (two years to important, no matter how prevent early payment the change of advisory in investment fees. advisory agreements from triggering the many shares you own. Potential expects BlackRocks Increased Sourcing vast network and Origination of corporate, Opportunities asset owner for and HLEND bank. HPS relationships to potentially offer significant incre-to mental offer sourcing holistic solutions breadth. for Access borrowers, to the broader further solidifying suite of BlackRock its position capabilities as a scaled, is also creative expected financing to enhance partner HPSs with capital ability flexibility. HPS believes these factors will result in a larger number of attractive potential investment opportunities. BlackRocks HLEND can potentially Scale Offers benefit Other from Potential increased Benefits economies for HLEND of scale Shareholders in areas such . HPS as believes vendor that, services, following execution the transaction, costs and access from BlackRocks to innovative robust technology research . HPS and further educational believes content that .HLEND, its shareholders, and their advisors may also benefit This letter is not an offer or sale of any security or investment product. Any offer or solicitation of HLEND can only be made through the applicable offering materials which investors are urged to read prior to investing. Past performance is not a guarantee of future results. This letter may include forward-looking statements which are uncertain and outside of HLENDs control and may differ from actual results materially. We do not undertake any duty to update these statements. For a discussion of the risks that could affect results, please see the risk factors section of the HLEND prospectus.

The following cover e-mail will be sent to shareholders of the Company by Broadridge Financial Solutions (Broadridge), the proxy solicitor providing proxy solicitation services on behalf of the Company, beginning on or about February 18, 2025, regarding the Special Meeting.

Schmit, Victoria From: SPECIMEN <id@proxyvote.com> Sent: Thursday, February 6, 2025 9:10 AM To: Butler, Laurie Subject: #HCLF25PXY# HPS CORPORATE LENDING FUND Special Meeting %S08494_0_ 0123456789012345_0000001% This Message Is From an External Sender This message came from outside your organization. Be the vote that counts. 1

HPS CORPORATE LENDING FUND 2025 Special Meeting April 16, 2025 VOTE NOW Why Should I Vote? As an HLEND shareholder, we need your vote in connection with BlackRock Inc.s proposed acquisition of HPS Investment Partners, LLC. Your vote counts! Ways to Vote ProxyVote 800.690.6903 Virtual Meeting Important Information For holders as of February 6, 2025 Vote Common Shares by: Control Number: 0123456789012345 11:59 PM EST April 15, 2025 View documents to learn more: 2

Proxy Statement | Shareholder Letter | © 2025 Broadridge Financial Solutions Inc. P.O. Box 1310, Brentwood, NY 11717 ProxyVote and Broadridge are trademarks of Broadridge Financial Solutions Inc. CUSIP is a registered trademark of the American Bankers Association. All other registered marks belong to their respective owners. Email Settings | Terms and Conditions | Privacy Statement

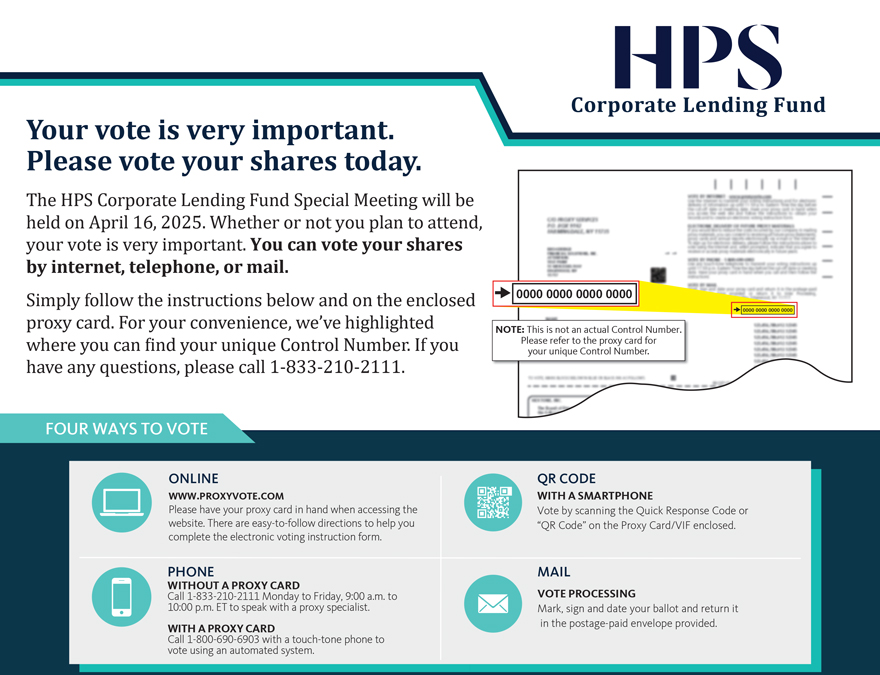

The following mailing insert will be sent to shareholders of the Company by Broadridge on behalf of the Company, beginning on or about February 18, 2025, regarding the Special Meeting.

Corporate Lending Fund Special Meeting of Shareholders Materials requiring your urgent action enclosed SAMPLE-EPB

Corporate Lending Fund Your vote is very important. Please The HPS Corporate vote Lending your Fund shares Special today Meeting. will be held on April very 16, 2025 important . Whether . or not you plan to attend, your vote is You can vote your shares by internet, telephone, or mail. Simply follow the instructions below and on the enclosed 0000 0000 0000 0000 proxy card. For your convenience, weve highlighted 0000 0000 0000 0000 NOTE: This is not an actual Control Number. where you can ind your unique Control Number. If you Please refer to the proxy card for have any questions, please call 1-833-210-2111. your unique Control Number. FOUR WAYS TO VOTE ONLINE QR CODE WWW.PROXYVOTE.COM WITH A SMARTPHONE Please have your proxy card in hand when accessing the Vote by scanning the Quick Response Code or website. There are easy-to-follow directions to help you QR Code on the Proxy Card/VIF enclosed. complete the electronic voting instruction form. PHONE MAIL WITHOUT A PROXY CARD Call 1-833-210-2111 Monday to Friday, 9:00 a.m. to VOTE PROCESSING 10:00 p.m. ET to speak with a proxy specialist. Mark, sign and date your ballot and return it in the postage-paid envelope provided. WITH A PROXY CARD Call 1-800-690-6903 with a touch-tone phone to vote using an automated system.

The following cover e-mail will be sent to certain shareholders of the Company by J.P. Morgan Chase & Co on behalf of the Company, beginning on or about February 18, 2025, regarding the Special Meeting.

February 2025

Important Action Requested: HPS Corporate Lending Fund Proxy Vote Due Monday, April 7, 2025

Dear Investor,

We are reaching out in connection with your investment in HPS Corporate Lending Fund (HLEND or the Fund). Please find enclosed the following (together, the Documents):

| | Definitive Proxy Statement, pursuant to section 14(a) of the Securities Exchange Act of 1934 (the Proxy Statement); and |

| | The Funds cover letter, summarizing the Proxy Statement (the Fund Letter). |

As you may recall, in December 2024 HPS Investment Partners, LLC (HPS) announced a definitive agreement to be acquired by BlackRock, Inc. (collectively with its affiliates, BlackRock) (the Transaction). The current investment advisory agreement automatically terminates upon its assignment which occurs when the Transaction closes due to the change in control of the parent company of HLENDs Investment Adviser (as defined below). To prevent any disruption in the Investment Advisers ability to provide services to HLEND, the Fund is seeking your approval of the proposed investment advisory agreement (the New Investment Advisory Agreement) with HPS Advisors, LLC (HLENDs Investment Adviser) (the New Investment Advisory Agreement Proposal), due by Monday, April 7, 2025.

Please note that the only changes to the terms of the New Investment Advisory Agreement are:

| | The time period over which the agreement will be in force (two years following the closing of the transaction); and |

| | The inclusion of a provision to prevent the change in investment advisory agreements from triggering the early payment of advisory fees. |

As an administrative matter, the Fund is also seeking your approval to contingently delay the Special Meeting of Shareholders, if necessary, to meet the minimum voting requirements (the Adjournment Proposal), as defined on page 28 in the Proxy Statement.

All members of HLENDs Board of Trustees who considered the Proposals (as defined below) unanimously recommend that you vote in favor of the New Investment Advisory Agreement

Please refer to the Prospectus for capitalized terms not defined above.

This material has been prepared by J.P. Morgan Securities LLC and approved for distribution by the following legal entities subject to applicable law:

J.P. Morgan Securities LLC, 383 Madison Ave, New York, NY 10017

J.P. Morgan SE (JPMSE), Taunustor 1 (TaunusTurm), 60310 Frankfurt am Main, Germany. JPMSE is authorised as a credit institution by the Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht, BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB). London Branch, 25 Bank Street, London E14 5JP, United Kingdom. In the UK, J.P. Morgan SE is also authorised by the Prudential Regulation Authority (PRA), subject to regulation by the Financial Conduct Authority (FCA) and limited regulation by the PRA. Details about the extent of our regulation by the FCA and the PRA are available from us on request. Sucursal en España, Paseo de la Castellana 31, 28046 Madrid, Spain. Milan Branch, Via Cordusio, n.3 20123, Milan, Italy. Luxembourg Branch, European Bank and Business Centre, 6 route de Treves, L-2633, Senningerberg, Luxembourg. Paris Branch, 14, Place Vendome 75001, Paris, France, Authorised and regulated by the Autorité de Contrôle Prudentiel et de Resolution (ACPR) and the Autorité des Marchés Financiers (AMF). Amsterdam Branch, World Trade Centre, Tower B, Strawinskylaan 1135, 1077 XX, Amsterdam, The Netherlands. Copenhagen Br, Kalvebod Brygge 39-41, 1560 København V, Denmark. Stockholm Bankfilial, Hamngatan 15, Stockholm, 11147, Sweden.

JPMorgan Chase Bank, N.A., 383 Madison Ave, New York, NY 10017, Hong Kong Branch, 27th Floor, Chater House, 8 Connaught Road Central, Hong Kong, Singapore Branch, 17th Floor, Capital Tower, 168 Robinson Road, Singapore 068912.

JPMorgan Chase Bank, N.A. and its affiliates (collectively JPMCB) offer investment products, which may include bank-managed accounts and custody, as part of its trust and fiduciary services. Other investment products and services, such as brokerage and advisory accounts, are offered through J.P. Morgan Securities LLC (JPMS), a member of FINRA and SIPC. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. JPMCB, JPMS and CIA are affiliated companies under the common control of JPMorgan Chase & Co. Products are not available in all states.

| INVESTMENT AND INSURANCE PRODUCTS ARE: NOT FDIC INSURED NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, JPMORGAN CHASE BANK, N.A. OR ANY OF ITS AFFILIATES SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED |

Proposal and the Adjournment Proposal (together, the Proposals), as detailed on page i of the Proxy Statement and summarized as follows:

| 1. | Approval of the New Investment Advisory Agreement Proposal (Proposal 1) between HLEND and HPS Advisors, LLC, which will replace the current investment advisory agreement and take effect upon the closing of the Transaction; and |

| 2. | Approval of the Adjournment Proposal (Proposal 2) to contingently delay the Special Meeting on Wednesday, April 16, 2025 in order to solicit more votes for the New Investment Advisory Agreement, if necessary. |

The Special Meeting will take place virtually via webcast. On the day of the Special Meeting, tentatively planned for Wednesday, April 16, 2025, clients can attend the meeting as guests by accessing the link below and entering the provided details:

Special Meeting Link: www.virtualshareholdermeeting.com/HLEND2025SM

First Name: J.P. Morgan

Last Name: Private Client

Email: JPM.Alternatives.IR@jpmorgan.com

Please read the Proxy Statement and the rationale from HPS supporting the Transaction, starting on page two of the enclosed Fund Letter. As a reminder, if the Transaction is consummated, BlackRock will acquire 100% of the business and assets of HPS, and the current leadership team of HPS will become employees of BlackRock and will continue to manage the key strategic direction, operations, and activities of the HPS business, subject to the generally applicable policies of BlackRock. We would highlight the importance of your vote in meeting the minimum quorum requirements.

Please sign with ink the enclosed J.P. Morgan Election Form on the following page, and return it to your J.P. Morgan team member no later than 5 PM Eastern Standard Time on Monday, April 7, 2025 by e-mailing a scan or clear picture to jpm.alts.corp.actions@jpmchase.com. Please reach out to your J.P. Morgan team member if you would like to return the Election Form via DocuSign.

Your vote on the Proposals is important. Please note that if you do not respond, your shares will not be voted at the Special Meeting of Shareholders and your shares will not be counted toward the minimum number of votes required to approve the Proposals. Elections received after the Monday, April 7, 2025 deadline will be accepted on a best-efforts basis.

Please refer to the Prospectus for capitalized terms not defined above.

This material has been prepared by J.P. Morgan Securities LLC and approved for distribution by the following legal entities subject to applicable law:

J.P. Morgan Securities LLC, 383 Madison Ave, New York, NY 10017

J.P. Morgan SE (JPMSE), Taunustor 1 (TaunusTurm), 60310 Frankfurt am Main, Germany. JPMSE is authorised as a credit institution by the Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht, BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB). London Branch, 25 Bank Street, London E14 5JP, United Kingdom. In the UK, J.P. Morgan SE is also authorised by the Prudential Regulation Authority (PRA), subject to regulation by the Financial Conduct Authority (FCA) and limited regulation by the PRA. Details about the extent of our regulation by the FCA and the PRA are available from us on request. Sucursal en España, Paseo de la Castellana 31, 28046 Madrid, Spain. Milan Branch, Via Cordusio, n.3 20123, Milan, Italy. Luxembourg Branch, European Bank and Business Centre, 6 route de Treves, L-2633, Senningerberg, Luxembourg. Paris Branch, 14, Place Vendome 75001, Paris, France, Authorised and regulated by the Autorité de Contrôle Prudentiel et de Resolution (ACPR) and the Autorité des Marchés Financiers (AMF). Amsterdam Branch, World Trade Centre, Tower B, Strawinskylaan 1135, 1077 XX, Amsterdam, The Netherlands. Copenhagen Br, Kalvebod Brygge 39-41, 1560 København V, Denmark. Stockholm Bankfilial, Hamngatan 15, Stockholm, 11147, Sweden.

JPMorgan Chase Bank, N.A., 383 Madison Ave, New York, NY 10017, Hong Kong Branch, 27th Floor, Chater House, 8 Connaught Road Central, Hong Kong, Singapore Branch, 17th Floor, Capital Tower, 168 Robinson Road, Singapore 068912.

JPMorgan Chase Bank, N.A. and its affiliates (collectively JPMCB) offer investment products, which may include bank-managed accounts and custody, as part of its trust and fiduciary services. Other investment products and services, such as brokerage and advisory accounts, are offered through J.P. Morgan Securities LLC (JPMS), a member of FINRA and SIPC. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. JPMCB, JPMS and CIA are affiliated companies under the common control of JPMorgan Chase & Co. Products are not available in all states.

| INVESTMENT AND INSURANCE PRODUCTS ARE: NOT FDIC INSURED NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, JPMORGAN CHASE BANK, N.A. OR ANY OF ITS AFFILIATES SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED |

Please contact your J.P. Morgan team member with any questions. If you received these documents in hard copy and would like to receive them electronically in the future, please also contact your J.P. Morgan team member.

Additionally, if you are a person with a disability and need support with this message, please contact your J.P. Morgan team member or email us at accessibility.support@jpmorgan.com for assistance.

Sincerely,

J.P. Morgan

Please refer to the Prospectus for capitalized terms not defined above.

This material has been prepared by J.P. Morgan Securities LLC and approved for distribution by the following legal entities subject to applicable law:

J.P. Morgan Securities LLC, 383 Madison Ave, New York, NY 10017

J.P. Morgan SE (JPMSE), Taunustor 1 (TaunusTurm), 60310 Frankfurt am Main, Germany. JPMSE is authorised as a credit institution by the Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht, BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB). London Branch, 25 Bank Street, London E14 5JP, United Kingdom. In the UK, J.P. Morgan SE is also authorised by the Prudential Regulation Authority (PRA), subject to regulation by the Financial Conduct Authority (FCA) and limited regulation by the PRA. Details about the extent of our regulation by the FCA and the PRA are available from us on request. Sucursal en España, Paseo de la Castellana 31, 28046 Madrid, Spain. Milan Branch, Via Cordusio, n.3 20123, Milan, Italy. Luxembourg Branch, European Bank and Business Centre, 6 route de Treves, L-2633, Senningerberg, Luxembourg. Paris Branch, 14, Place Vendome 75001, Paris, France, Authorised and regulated by the Autorité de Contrôle Prudentiel et de Resolution (ACPR) and the Autorité des Marchés Financiers (AMF). Amsterdam Branch, World Trade Centre, Tower B, Strawinskylaan 1135, 1077 XX, Amsterdam, The Netherlands. Copenhagen Br, Kalvebod Brygge 39-41, 1560 København V, Denmark. Stockholm Bankfilial, Hamngatan 15, Stockholm, 11147, Sweden.

JPMorgan Chase Bank, N.A., 383 Madison Ave, New York, NY 10017, Hong Kong Branch, 27th Floor, Chater House, 8 Connaught Road Central, Hong Kong, Singapore Branch, 17th Floor, Capital Tower, 168 Robinson Road, Singapore 068912.

JPMorgan Chase Bank, N.A. and its affiliates (collectively JPMCB) offer investment products, which may include bank-managed accounts and custody, as part of its trust and fiduciary services. Other investment products and services, such as brokerage and advisory accounts, are offered through J.P. Morgan Securities LLC (JPMS), a member of FINRA and SIPC. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. JPMCB, JPMS and CIA are affiliated companies under the common control of JPMorgan Chase & Co. Products are not available in all states.

| INVESTMENT AND INSURANCE PRODUCTS ARE: NOT FDIC INSURED NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, JPMORGAN CHASE BANK, N.A. OR ANY OF ITS AFFILIATES SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED |

ELECTION FORM

HPS Corporate Lending Fund (HLEND) Proxy Vote

Please sign with ink and return this Form no later than 5 PM Eastern Standard Time on Monday, April 7, 2025 by e-mailing a scan or clear picture to jpm.alts.corp.actions@jpmchase.com.

Proposal 1: Approval of the New Investment Advisory Agreement between HLEND and HPS Advisors, LLC, which will replace the current investment advisory agreement and take effect upon the closing of the Transaction. (please check one)

| ☐ | The undersigned Investor hereby votes FOR Proposal 1. |

| ☐ | The undersigned Investor hereby votes AGAINST Proposal 1. |

| ☐ | The undersigned Investor hereby ABSTAINS to Proposal 1. |

Proposal 2: Approval to contingently delay the Special Meeting of Shareholders on Wednesday, April 16, 2025 in order to solicit more votes for the New Investment Advisory Agreement, if necessary. (please check one)

| ☐ | The undersigned Investor hereby votes FOR Proposal 2. |

| ☐ | The undersigned Investor hereby votes AGAINST Proposal 2. |

| ☐ | The undersigned Investor hereby ABSTAINS to Proposal 2. |

| Account Number:_____________________ | Date:_______________________ | |||

| For IRA Investors Only | ||||

|

|

|

|||

| Print Name of Owner of IRA | Print Name of Custodian or Trustee of IRA | |||

|

|

|

|||

| Signature of Owner of IRA | Signature of Custodian or Trustee of IRA | |||

Please refer to the Prospectus for capitalized terms not defined above.

This material has been prepared by J.P. Morgan Securities LLC and approved for distribution by the following legal entities subject to applicable law:

J.P. Morgan Securities LLC, 383 Madison Ave, New York, NY 10017

J.P. Morgan SE (JPMSE), Taunustor 1 (TaunusTurm), 60310 Frankfurt am Main, Germany. JPMSE is authorised as a credit institution by the Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht, BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB). London Branch, 25 Bank Street, London E14 5JP, United Kingdom. In the UK, J.P. Morgan SE is also authorised by the Prudential Regulation Authority (PRA), subject to regulation by the Financial Conduct Authority (FCA) and limited regulation by the PRA. Details about the extent of our regulation by the FCA and the PRA are available from us on request. Sucursal en España, Paseo de la Castellana 31, 28046 Madrid, Spain. Milan Branch, Via Cordusio, n.3 20123, Milan, Italy. Luxembourg Branch, European Bank and Business Centre, 6 route de Treves, L-2633, Senningerberg, Luxembourg. Paris Branch, 14, Place Vendome 75001, Paris, France, Authorised and regulated by the Autorité de Contrôle Prudentiel et de Resolution (ACPR) and the Autorité des Marchés Financiers (AMF). Amsterdam Branch, World Trade Centre, Tower B, Strawinskylaan 1135, 1077 XX, Amsterdam, The Netherlands. Copenhagen Br, Kalvebod Brygge 39-41, 1560 København V, Denmark. Stockholm Bankfilial, Hamngatan 15, Stockholm, 11147, Sweden.

JPMorgan Chase Bank, N.A., 383 Madison Ave, New York, NY 10017, Hong Kong Branch, 27th Floor, Chater House, 8 Connaught Road Central, Hong Kong, Singapore Branch, 17th Floor, Capital Tower, 168 Robinson Road, Singapore 068912.

JPMorgan Chase Bank, N.A. and its affiliates (collectively JPMCB) offer investment products, which may include bank-managed accounts and custody, as part of its trust and fiduciary services. Other investment products and services, such as brokerage and advisory accounts, are offered through J.P. Morgan Securities LLC (JPMS), a member of FINRA and SIPC. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. JPMCB, JPMS and CIA are affiliated companies under the common control of JPMorgan Chase & Co. Products are not available in all states.

| INVESTMENT AND INSURANCE PRODUCTS ARE: NOT FDIC INSURED NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, JPMORGAN CHASE BANK, N.A. OR ANY OF ITS AFFILIATES SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED |

| For Individuals or Joint Accounts: |

For Entities: |

|

|

Print Name of Investor |

Print Name of Investor |

|

|

Signature of Investor |

Signature of Investor |

|

|

Print Name of Joint Investor (if applicable) |

Name and Title of Signatory |

|

|

Signature of Joint Investor or Authorized Signatory pursuant to valid power of attorney |

||

Please refer to the Prospectus for capitalized terms not defined above.

This material has been prepared by J.P. Morgan Securities LLC and approved for distribution by the following legal entities subject to applicable law:

J.P. Morgan Securities LLC, 383 Madison Ave, New York, NY 10017

J.P. Morgan SE (JPMSE), Taunustor 1 (TaunusTurm), 60310 Frankfurt am Main, Germany. JPMSE is authorised as a credit institution by the Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht, BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB). London Branch, 25 Bank Street, London E14 5JP, United Kingdom. In the UK, J.P. Morgan SE is also authorised by the Prudential Regulation Authority (PRA), subject to regulation by the Financial Conduct Authority (FCA) and limited regulation by the PRA. Details about the extent of our regulation by the FCA and the PRA are available from us on request. Sucursal en España, Paseo de la Castellana 31, 28046 Madrid, Spain. Milan Branch, Via Cordusio, n.3 20123, Milan, Italy. Luxembourg Branch, European Bank and Business Centre, 6 route de Treves, L-2633, Senningerberg, Luxembourg. Paris Branch, 14, Place Vendome 75001, Paris, France, Authorised and regulated by the Autorité de Contrôle Prudentiel et de Resolution (ACPR) and the Autorité des Marchés Financiers (AMF). Amsterdam Branch, World Trade Centre, Tower B, Strawinskylaan 1135, 1077 XX, Amsterdam, The Netherlands. Copenhagen Br, Kalvebod Brygge 39-41, 1560 København V, Denmark. Stockholm Bankfilial, Hamngatan 15, Stockholm, 11147, Sweden.

JPMorgan Chase Bank, N.A., 383 Madison Ave, New York, NY 10017, Hong Kong Branch, 27th Floor, Chater House, 8 Connaught Road Central, Hong Kong, Singapore Branch, 17th Floor, Capital Tower, 168 Robinson Road, Singapore 068912.

JPMorgan Chase Bank, N.A. and its affiliates (collectively JPMCB) offer investment products, which may include bank-managed accounts and custody, as part of its trust and fiduciary services. Other investment products and services, such as brokerage and advisory accounts, are offered through J.P. Morgan Securities LLC (JPMS), a member of FINRA and SIPC. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. JPMCB, JPMS and CIA are affiliated companies under the common control of JPMorgan Chase & Co. Products are not available in all states.

| INVESTMENT AND INSURANCE PRODUCTS ARE: NOT FDIC INSURED NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, JPMORGAN CHASE BANK, N.A. OR ANY OF ITS AFFILIATES SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED |